ESOPs: The Emerging Ownership Model for Heavy Civil and General Contractors

/in Articles, Insights WideThis article was first published in November 2024 and updated in July 2025.

Are you thinking about selling your heavy civil construction or general contracting company? If so, you may be wondering what your best options are for succession and transition. In most industries, business owners typically have to choose between a sale to a strategic acquirer or to a financial buyer (e.g. private equity).

However, for heavy civil and general contractors, the buyer pool is often more limited, primarily consisting of large, well-capitalized strategics. This is largely due to the fact that contractors are not well suited to the highly leveraged acquisition models favored by financial buyers.

Construction M&A Realities

While strategics may have to hold significant reserves of cash, they are often reluctant to pursue acquisitions proactively, preferring to maintain liquidity in case of industry downturns.

Even when acquisition opportunities arise, these larger strategics often move slowly, taking an increasingly cautious approach to both valuation and the overall transaction process.

Adding to the complexity, surety bond obligations make M&A transactions in this industry more difficult, further reducing private equity’s interest in the sector.

Surety underwriters assess a company’s financial strength by evaluating its capital structure, liquidity, and the stability of its management team. If an acquisition introduces significant debt or results in the loss of key leadership, the surety may decline to issue bonds—raising concerns about the company’s financial viability and continuity, both of which are essential for maintaining bonding capacity.

(1) NCEO; BaseRock Analysis

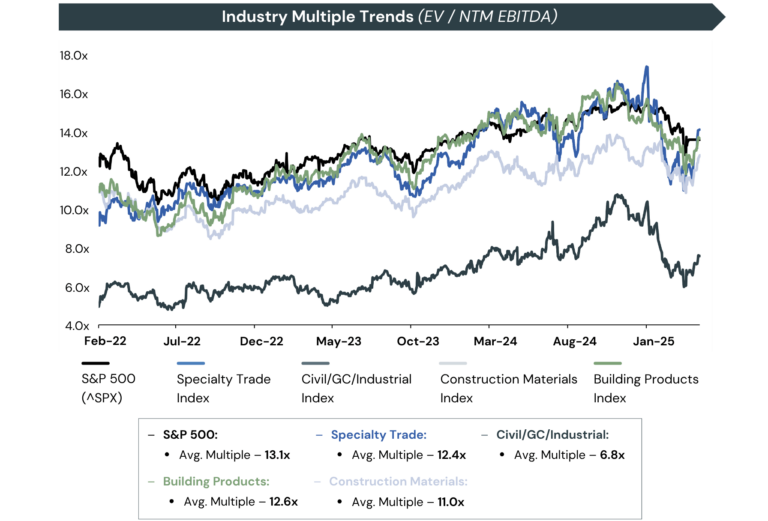

Public Market Insights: Valuations Substantiate Expectations

The challenges facing heavy civil and general contractors are reflected in both private and public market valuations. As shown in the chart below, publicly traded heavy civil and GC comparables trade at a significant discount compared to specialty contractors and other construction-adjacent sectors.

This valuation gap is driven by factors such as project-based cash flows, surety requirements, and lower margins – all of which increase perceived risk and contribute to compressed EBITDA multiples.

ESOPs by the Numbers

The M&A market in the heavy civil and general contracting industry tends to be sluggish, with owners often relying on favorable timing and market circumstances for a successful sale.

These conditions have led heavy civil and general contractor owners to identify Employee Stock Ownership Plans (ESOPs) as a compelling solution with significant advantages for both owners and employees.

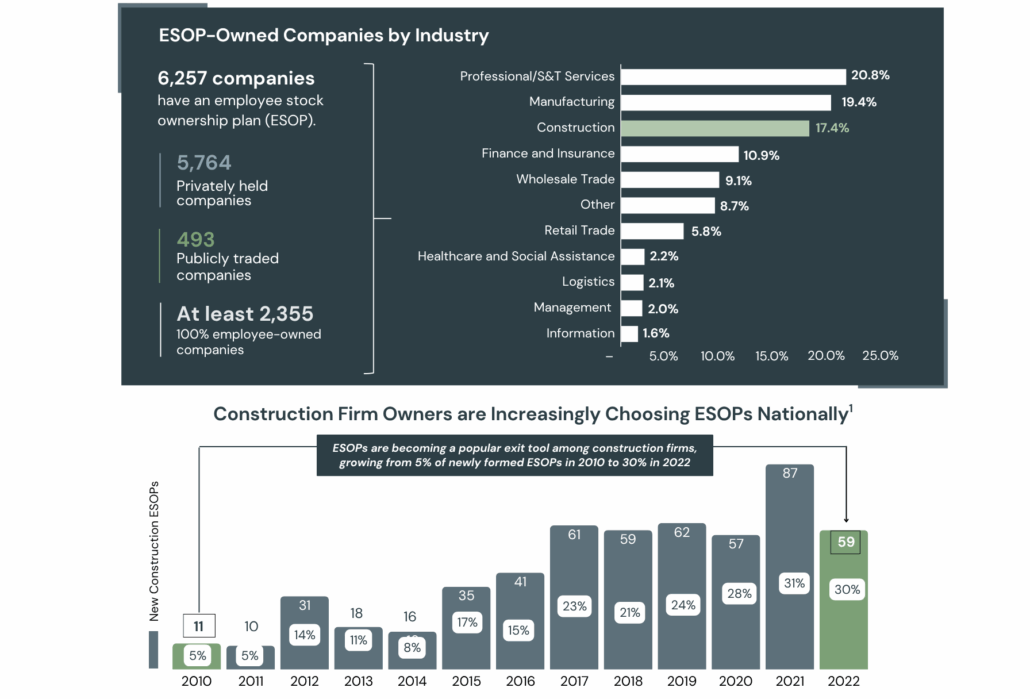

- • Construction companies account for 17.4% of existing ESOPs in the U.S.

- • Representing 30% of new formations annually, the construction industry is now the fastest-growing cohort of ESOPs

- • Across all industries, ~15 million employees participate in ESOPs, with 250+ plans established annually

(1) NCEO; BaseRock Analysis

Formation Trends: ESOP Adoption by Industry Subsector

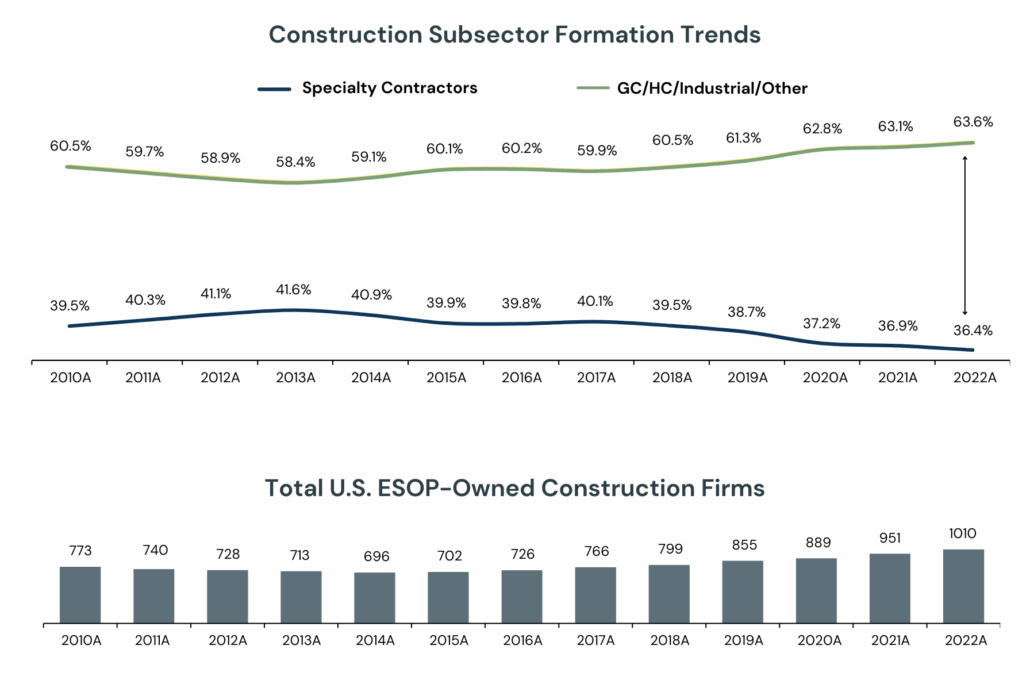

When we analyzed the data, it confirmed what we have seen anecdotally: most companies pursuing ESOPs are general contractors, industrial contractors, and heavy civil firms. Private equity typically avoids these sectors due to bonding requirements, cyclicality, and thinner margins.

In contrast, specialty contractors—such as mechanical, electrical, plumbing, and other trade-focused firms—tend to have recurring revenue, higher margins, and less exposure to bonding risks. These characteristics make them more attractive to private equity, which is why they are more likely to pursue traditional M&A exits.

Since 2018, the number of ESOP formations among heavy civil and general contracting firms has been nearly twice that of specialty contractors.

- • Since 2018, specific industry subsets have formed ESOPs at an accelerating rate:

- • GC/HC/Industrial: 7.0% CAGR | 650+ Firms

- • Specialty Contracting: 3.4% CAGR | 350+ Firms

What Is an Employee Stock Ownership Plan—and Why Is It an Attractive Option?

Given the mechanics and complexity of an ESOP transaction, it’s crucial to understand why these plans are gaining popularity in the heavy civil and general contracting industry and how they can be a valuable component of a company’s succession planning strategy.

An ESOP is a type of qualified retirement plan, similar to a 401(k) or profit-sharing plan, designed to provide employees with retirement income over time. What makes an ESOP unique is its dual function, not only offering retirement benefits but also facilitating the transfer of business ownership to future leaders.

In an ESOP, the current owner sells either a portion or all of their ownership interest in the business to the plan, allowing employees to become participants in the ownership structure.

Importantly, the owner is not obligated to divest their entire stake at once; there is no minimum percentage of company stock an ESOP must hold when established. In the construction industry, owners typically structure ESOPs to include between 30% and 100% of the company’s shares.

While most new ESOP transactions involve a 100% sale, it’s also common for owners to transition ownership gradually through a series of smaller sales over time. For sellers, an ESOP also affords value built over decades, enables tax-efficient estate planning, and helps preserve the company’s culture and legacy.

Advantages of the ESOP Structure¹

ESOPs can offer selling shareholders the opportunity to defer or even eliminate capital gains taxes on the proceeds from the sale. Additionally, 100% ESOP-owned S-Corporations are exempt from most, if not all, state and federal income taxes, which can significantly boost cash flow.

ESOPs may maintain the existing management and operational structures, potentially minimizing disruptions for employees and customers while aiming to secure the company’s legacy.

ESOPs provide employees with additional retirement benefits at no extra cost to the company, making them a valuable tool for attracting and retaining talent.

Data from the NCEO shows that companies with ESOPs are 25% more likely to remain in business, highlighting their role in fostering long-term stability.

According to the NCEO, employees in ESOP-owned companies typically have 2.5 times more retirement savings compared to workers in non-ESOP firms.

(1) NECO

Is an ESOP Right for You and Your Construction Business?

While an ESOP offers numerous benefits, it’s essential to assess whether this ownership transition method is a good fit for your heavy civil construction or general contracting business.

The following considerations are critical to keep in mind:

-

- → Strong Company Culture

- ESOPs are designed to enhance employee alignment and engagement, but they can’t create cohesion where it doesn’t already exist. For an ESOP to succeed, employee engagement is critical. In companies with high turnover or strained employee relations, this can be a significant challenge.

- → Strong Company Culture

- → Established Business with Stable Cash Flows

- Since ESOPs are often financed through debt, companies with unstable cash flows may face heightened risks. Heavy civil and general contractors with consistent, stable cash flow are better positioned for successful ESOP transactions. An experienced advisor can help structure the deal to safeguard the company through industry cycles, ensuring a smoother transition.

- → Established Business with Stable Cash Flows

- → Bonding Requirements

- Surety bonds may introduce financial covenants or conditions that can complicate ESOP transactions. While bonding requirements don’t necessarily exclude a company from pursuing an ESOP, those with significant bonding needs must carefully structure the transaction and communicate proactively with sureties to avoid any disruptions in coverage that could affect business performance.

- → Bonding Requirements

- → Patient Capital

- Sellers in an ESOP transaction typically receive a combination of cash, seller notes, and equity in the form of warrants. Depending on the company’s ability to secure external senior debt, a significant portion of the proceeds may come from seller notes, with repayment terms extending over 7–10 years. A long-term perspective is crucial for sellers in this type of transaction.

- → Patient Capital

- → Estate Planning Opportunities

- There are many estate planning opportunities for ESOPs, including leveraging Section 1042 for deferral of capital gains and potential step-up in basis for permanent tax avoidance, as well as gifting warrants at a reduced price for future economic benefit.

- → Estate Planning Opportunities

Choose BaseRock Partners as Your ESOP Advisor for Your Construction Company

BaseRock Partners is a recognized and trusted advisor to construction and engineering company owners considering an ESOP as a transition strategy. Our team is well-versed in the unique challenges of the construction industry, including surety, licensing, lending requirements, and M&A complexities. We leverage this knowledge to:

-

-

Guide business owners through the decision-making process, helping determine whether an ESOP is the best path to achieving their personal and business goals.

-

Design tailored ESOP transactions that align with the unique needs of all parties involved, ensuring an optimal outcome for the owner, the company, and its employees.

-

We also collaborate closely with the essential partners in the ESOP process, including CPAs, attorneys, and trustees. We understand the critical role each party plays in structuring the deal to maximize advantages for everyone involved.

Contact BaseRock Partners to discuss your business ownership transition goals and learn about the advantages of an ESOP for your construction company.

What Our Clients Say

Dave Wells

President, Key Construction

“Pursuing an ESOP was a natural choice for our company. We wanted to ensure our founder’s legacy lived on while preserving the culture and reputation that set us apart. Our accounting firm introduced us to BaseRock Partners, and from day one, they instilled confidence in us. Their deep expertise and ability to clearly outline each step of the process made all the difference. The BaseRock team was with us every step of the way; educating, advising, and ensuring we had everything in place to achieve a successful outcome. Their professionalism and strategic guidance were invaluable. We couldn’t be more pleased with our experience and would highly recommend BaseRock to any company considering an ESOP.”

Bob Maddox

Chairman, Allied Construction Services

“BaseRock Partners provided exceptional insight and advice as we navigated a very difficult decision-making process,” said Dick Ghilotti, Founder, Ghilotti Construction Company, one of the nation’s largest heavy civil construction firms. “Their leadership, market knowledge, and financial acumen were critically important to our owners and executive team. BaseRock will continue to be trusted advisors to our firm as we enter our next 100 years as an employee-owned company.”

Dick Ghilotti

Founder, Ghilotti Construction Company

“At Brix Paving Northwest, we believe in the incredible talent and dedication of our team. That’s why we decided to sell the company to our employees through an ESOP. They have contributed so much to our success, and now they get to write the next chapter,” said Billy Stimpson, President of Brix. “We’re grateful to BaseRock Partners for partnering with us on this process. We couldn’t have done it without their expertise. Their reputation as a leader in this field is well-deserved.

Billy Stimpson

President of Brix Paving Northwest

“BaseRock Partners came highly recommended to us within the construction industry, and their reputation as a leader in this field is well-deserved,” said Doug McAninch, owner of McAninch Corporation. Their guidance and expertise were instrumental in helping us navigate the complex process of transitioning to an ESOP. BaseRock not only provided valuable insight but also led us with precision through each step of the journey. We couldn’t have asked for a more capable partner during this pivotal time for McAninch Corporation.”